Got my taxes done. Usually fairly easy. I had got a $100,000 inheritance few years ago which was to pay for a boat and a vehicle. I messed up and put it with Fidelity just before the market went to hell. Been waiting for it to come back before I withdraw it. I had $20,000 realized losses on it last year. Took forever to figure out how to put into TaxAct. Had to use a website called form8949 to import all those transactions. To qualify for the health insurance plan I have to keep my yearly income at $25,000. Now I worried when and if my account comes back I will have to claim that as income now. It is hard enough to play this yearly income game for health insurance. Was planning on starting SS in few months. This sucks. I sure wish I could have that day back. Its time for a drink.

Doing Taxes Got My Head Spinning

- Thread starter BrianGSDTexoma

- Start date

-

Some of the links on this forum allow SMF, at no cost to you, to earn a small commission when you click through and make a purchase. Let me know if you have any questions about this.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

SmokingMeatForums.com is reader supported and as an Amazon Associate, we may earn commissions from qualifying purchases.

BGSDT, Have two drinks because it will get worse before it ever gets better.The gov't would and will screw up anything !

Timing early retirement is a slippery slope, and I used the Marketplace insurance, along with watching the income cap for a few years. The last year I went over, but the SECURE 2.0 act changed the rules, so my penalty was pretty light.

Just keep in mind, you don't get taxed on investment profit until you sell. But in the meantime, you are taxed on dividends and cap gains. Selling at a loss is a different strategy.

Just keep in mind, you don't get taxed on investment profit until you sell. But in the meantime, you are taxed on dividends and cap gains. Selling at a loss is a different strategy.

Last edited:

It just sucks when I get back to even I will have a $20,000 gain I would have to claim which would be almost my whole year income. If I collecting SS that really going to throw a wrench in it. I was really wanting to pull that money out to pay off boat and new truck I looking to get. They could sell and reinvest like they did last year at any time which would give me cap gains. I thinking about just taking the loss and pulling it and chalk up to experience.Timing early retirement is a slippery slope, and I used the Marketplace insurance, along with watching the income cap for a few years. The last year I went over, but the SECURE 2.0 act changed the rules, so my penalty was pretty light.

Just keep in mind, you don't get taxed on investment profit until you sell. But in the meantime, you are taxed on dividends and cap gains. Selling at a loss is a different strategy.

Last edited:

It just sucks when I get back to even I will have a $20,000 gain I would have to claim which would be almost my whole year income. If I collecting SS that really going to throw a wrench in it. I was really wanting to pull that money out to pay off boat and new truck I looking to get. They could sell and reinvest like they did last year at any time which would give me cap gains. I thinking about just taking the loss and pulling it and chalk up to experience.

Well, you had a good plan, but it's really hard to time the market because you have to be right twice.... once when you buy, and again when you sell. Hence the old saying "time in the market works better than timing the market".

But I'm confused when you mentioned getting back to even and claiming a $20,000 gain. Your initial cost basis was $100,000 then the stocks or funds lost $20,000 leaving your account balance at $80,000. Once your account balance gets back to $100,000... and if you sell, you didn't actually make any money to be taxed on.

Now, during your investment time, you may have gotten dividends, cap gains or even interest each year, and you do claim that as income even if it's re-invested.

What happened was they moved out of funds I was in and bought new ones. So when that happened I have a realized $20,000 loss. Now as those new funds go up its all considered gain. Not a big deal if it where in an IRA. I got appt to talk to them tomorrow. I have to walk this tight rope until I 65.Well, you had a good plan, but it's really hard to time the market because you have to be right twice.... once when you buy, and again when you sell. Hence the old saying "time in the market works better than timing the market".

But I'm confused when you mentioned getting back to even and claiming a $20,000 gain. Your initial cost basis was $100,000 then the stocks or funds lost $20,000 leaving your account balance at $80,000. Once your account balance gets back to $100,000... and if you sell, you didn't actually make any money to be taxed on.

Now, during your investment time, you may have gotten dividends, cap gains or even interest each year, and you do claim that as income even if it's re-invested.

Now I gotcha. Hopefully, your tax strategy will be able to turn that loss into future tax savings.What happened was they moved out of funds I was in and bought new ones. So when that happened I have a realized $20,000 loss.

From a tax efficient standpoint, index funds/ETF's are better than active management mutual funds for capital gains. Since there is less manager selling, you will only pay capital gains when you sell.

TripleLindy

Smoke Blower

^^^ This ^^^^. Especially if you’ve retired early and have to manage investment income for the ACA subsidy. I’m in the same boat - retired at 55 and another 5 years until I’m eligible for Medicare. You might consider managing your $ on your own. If you follow a simple portfolio model (like Scott Burns’ Couch Potato), it will take you all of 5 minutes each year and is super easy. And it will outperform 95% of all managed portfolios.From a tax efficient standpoint, index funds/ETF's are better than active management mutual funds for capital gains. Since there is less manager selling, you will only pay capital gains when you sell.

Sounds like it’s too late for this year, but considering TurboTax in future years. Most brokerage 1099s have a document ID on them. Enter that along with your account number and TurboTax imports everything in the right place. My tax return has a little complexity and it took me about 15 minutes.

If you weren’t able to use the $20k loss to offset other gains, it will carry forward. I suspect you used the $3k max against ordinary income if you didn’t have other capital gains.

From a tax efficient standpoint, index funds/ETF's are better than active management mutual funds for capital gains. Since there is less manager selling, you will only pay capital gains when you sell.

Thanks. I will look into that. Been a stressful few days. I did put $3000 toward last year. At such a low income I really down pay much taxes. I got Quicken now to make easier to know where I stand on Div's and Gains. I guess for now I will just pull it out of that account. I use to do my own investing than back in 2008 I lost over half my money and never recovered. Still makes my stomach turn. I decided than I would let someone else do it. My brother is great at it but does not want the responsibility. That ACA is a tough act. Four more years of it.^^^ This ^^^^. Especially if you’ve retired early and have to manage investment income for the ACA subsidy. I’m in the same boat - retired at 55 and another 5 years until I’m eligible for Medicare. You might consider managing your $ on your own. If you follow a simple portfolio model (like Scott Burns’ Couch Potato), it will take you all of 5 minutes each year and is super easy. And it will outperform 95% of all managed portfolios.

Sounds like it’s too late for this year, but considering TurboTax in future years. Most brokerage 1099s have a document ID on them. Enter that along with your account number and TurboTax imports everything in the right place. My tax return has a little complexity and it took me about 15 minutes.

If you weren’t able to use the $20k loss to offset other gains, it will carry forward. I suspect you used the $3k max against ordinary income if you didn’t have other capital gains.

TripleLindy

Smoke Blower

Don’t feel bad about that! Most everyone I know sustained heavy losses during the financial meltdown.back in 2008 I lost over half my money and never recovered.

Seriously, take a look at something like this:

The Scott Burns Couch Potato Portfolio can be implemented with the following ETFs:

| Weight | Ticker | ETF Name | Investment Themes | |

|---|---|---|---|---|

| 50.00 % | VTI | Vanguard Total Stock Market | Equity, U.S., Large Cap | |

| 50.00 % | TIP | iShares TIPS Bond | Bond, U.S., All-Term |

Most of Lazy Portfolios are made of common components (asset classes), very simple and well defined. For a more complete view, find out the most common ETFs you can use to build your portfolio.

That’s a very conservative 50/50 mix but at my age (60) it works just fine. If you can divide by 2 once a year when rebalancing, you can manage this portfolio.

- Jan 16, 2019

- 388

- 452

I also use just a couple of index funds for my investments, Total Stock Market and Total Bond market. Not only tax efficient, but fees are really really low to hold them. Crazy low expense ratio of .015% per thousand invested ($0.15 cents per $1000). Take a look at what is being charged both for the various fund itself and if the management company is charging a fee for their "services". Jack Bogle who started Vanguard and championed low cost index fund investing waged a holy war against high fees.

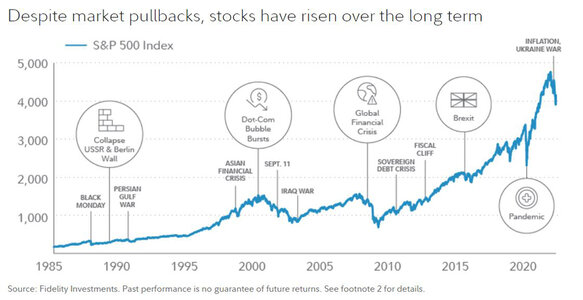

Yes it did, but I am crossing my fingers the chart is indicative of the past because look at the gains after drops.... The world HAS to return to "normal", doesn't it? Please...Then the pandemic drop broke a good run.

I went ahead and tried Turbo Tax so my losses will be there to import for next year. You right. That was easy! At least came out same as TaxAct. I played with income numbers to see what happens. When I get to over $5000 over my $25,000 cap I really start to get penalized! I have meeting with my Wells Fargo guy tomorrow. I need to get this figured out soon as I stressing to much. If I take the money out right now I looking at $12,000 gain for the year while still being down $15,000. This will put me at my $25,000 not including other things with SS I start in July . I will look at your recommendations when I get this figured out.Sounds like it’s too late for this year, but considering TurboTax in future years. Most brokerage 1099s have a document ID on them. Enter that along with your account number and TurboTax imports everything in the right place. My tax return has a little complexity and it took me about 15 minutes.

Last edited:

Murray

Smoking Fanatic

I feel for you. Sounds like the US tax structure is as complicated as the Canadian system. I’ve been using the Canadian edition of Turbo Tax and love it. A piece of advice I got from a tax expert, Canadian, but I’d bet the US is similar. ALWAYS claim any and all income otherwise that’s Tax Evasion, where you get creative is the expenses. For example we are allowed to claim expenses associated with medical appointments including meals, mileage, parking, hotels…When we leave town to see a specialist we visit the grandkids, stock up on groceries go to a movie. If I’m ever challenged on expenses and the Taxman denies it then I apologize and plead ignorance. Our tax laws are written by lawyers and in legalese not to mention complicated and convoluted. I’m just a middle class Canadian trying to do my best filling out my taxes. So far I’ve never been challenged. I’m banking on the CRA being underfunded and overworked, a situation I am assuming your IRS is similar.

Hire a CPA, it will cost you less than $500 to have them do things for you.

After hiring one, I wouldn't ever consider doing our taxes EVER again, and our taxes are fairly simple these days. Which is all going to change next yr after losing my mother inlaw to cancer the day after Christmas last yr.

We are cashing out her investments and buying my wife's bro out of the house.

Next tax season is going to be brutal on us.

Good luck.

After hiring one, I wouldn't ever consider doing our taxes EVER again, and our taxes are fairly simple these days. Which is all going to change next yr after losing my mother inlaw to cancer the day after Christmas last yr.

We are cashing out her investments and buying my wife's bro out of the house.

Next tax season is going to be brutal on us.

Good luck.

Your first mistake is banking with We'll For'go bank. Take your money out of that crap hole of a bank and join a credit union, you will make 2 to 4X more money with them in interest, and they will treat you like a friend.I went ahead and tried Turbo Tax so my losses will be there to import for next year. You right. That was easy! At least came out same as TaxAct. I played with income numbers to see what happens. When I get to over $5000 over my $25,000 cap I really start to get penalized! I have meeting with my Wells Fargo guy tomorrow. I need to get this figured out soon as I stressing to much. If I take the money out right now I looking at $12,000 gain for the year while still being down $15,000. This will put me at my $25,000 not including other things with SS I start in July . I will look at your recommendations when I get this figured out.

Well's sucks balls!!!

Yes they do. Thankfully the mortgage is paid off and we're done with that dumpster fire of a bank.Your first mistake is banking with We'll For'go bank. Take your money out of that crap hole of a bank and join a credit union, you will make 2 to 4X more money with them in interest, and they will treat you like a friend.

Well's sucks balls!!!

SmokingMeatForums.com is reader supported and as an Amazon Associate, we may earn commissions from qualifying purchases.

Similar threads

- Replies

- 18

- Views

- 5K

- Replies

- 9

- Views

- 1K

- Replies

- 12

- Views

- 4K

- Replies

- 14

- Views

- 1K

- Replies

- 17

- Views

- 5K

- Replies

- 44

- Views

- 45K

Hot Threads

-

Damn dishwasher....

- Started by Steve H

- Replies: 40

- Blowing Smoke Around the Smoker.

-

Featured Christmas Eve Lasagna , salad and sourdough

- Started by chopsaw

- Replies: 38

- General Discussion

-

Featured It's all fun and games until your kid decides she's coming for your crown.

- Started by Quiganomics

- Replies: 33

- General Discussion

-

Boneless ham ideas.

- Started by Steve H

- Replies: 29

- General Discussion